Maximum Ss Withholding 2025 - Asheville Spartan Race 2025. Mccormick farms, 7765 mccormick bridge. Join us at the tryon international equestrian center for the asheville, nc obstacle course race in 2025. Spartan trail deka peak ocrwc la ruta m20 highlander combat tough mudder. Spartan race | 2025 fayetteville obstacle course races. When Is Medicare Disability Taxable, Social security national press office baltimore, md. Supplemental security income (ssi) benefits overview.

Asheville Spartan Race 2025. Mccormick farms, 7765 mccormick bridge. Join us at the tryon international equestrian center for the asheville, nc obstacle course race in 2025. Spartan trail deka peak ocrwc la ruta m20 highlander combat tough mudder. Spartan race | 2025 fayetteville obstacle course races.

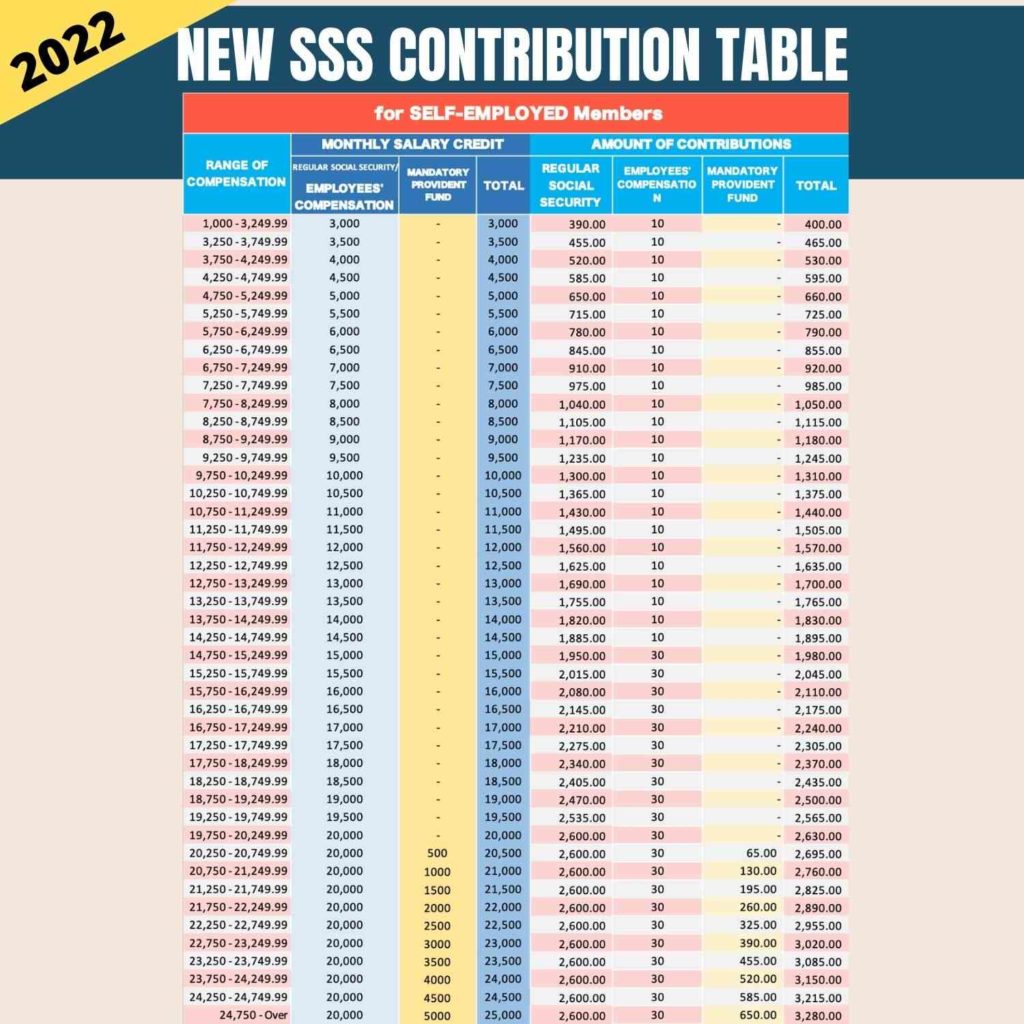

New SSS Contribution Table 2022, Once your income is over the wage cap and you’ve maxed out the withholding,. The social security tax rate.

How To Calculate, Find Social Security Tax Withholding Social, The social security limit is $168,600 for 2025, meaning any income you make over $168,600 will not be subject to social security tax. The year an individual reaches full $56,520/yr.

How Is Social Medicare Tax Withholding Calculator, 11 rows when you have more than one job in a year, each of your employers must withhold. For 2025, an employer must withhold:

Significance Of September 23 2025. In 1950, on march 23, the world meteorological organisation was founded to predict weather and climate changes. Because of time zone differences, the equinox. The zodiac star sign for this date is libra. The calculator, further below, determines the date number and presents an interpretation for the energy represented by […]

This means the maximum possible social security withholding in 2025 is $10,453.20.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Apply for part d extra help. The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent.

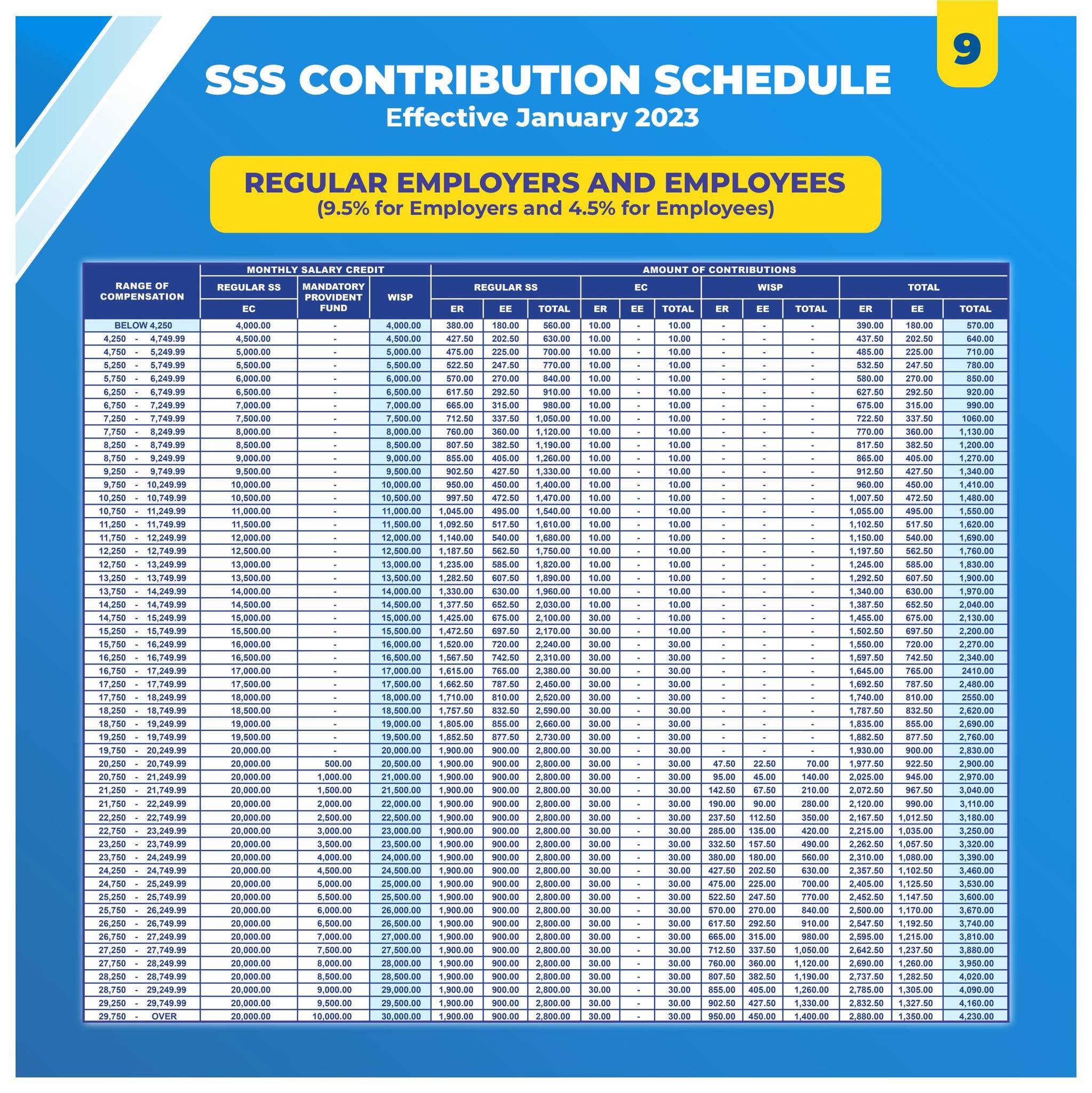

New SSS Contribution Table 2025 Schedule Effective January, Supplemental security income (ssi) benefits overview. If you are an employee, your employer probably withholds income tax from your pay.

2025 Form 943 Instructions. Irs finalizes 2025 form 943, instructions. Form 943, is the employer's annual federal tax. The draft instructions for the 2022 form 943, employer’s annual federal tax. Open form follow the instructions.

![Social Security Wage Base 2021 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

Limit For Maximum Social Security Tax 2022 Financial Samurai, What is the social security limit? The maximum amount of social security tax an employee will have withheld from their paycheck in 2025 will be $10,453.20 ($168,600 x 6.2%).

In 2025, the maximum amount of earnings on which you must pay social security tax is $168,600.

For 2025, the social security tax limit is $168,600. This is up from $9,932.40.

Maximum Ss Withholding 2025. You can get a jump on some. What is the maximum social security benefit available?

How To Calculate Medicare And Social Security Withholding, In 2025, this limit rises to $168,600, up from the 2025 limit of $160,200. What is the social security limit?

Maximum Social Security Benefit 2025 Calculation, If you are an employee, your employer probably withholds income tax from your pay. How much could you owe in social security tax?

Social Security Wage Base 2021 [Updated for 2025] UZIO Inc, But beyond that point, you'll have $1 in. This is up from $9,932.40.